CBN raises Minimum Capital Base For Banks At N500bn

The Central Bank of Nigeria (CBN) has unveiled new minimum capital requirements for banks, pegging the minimum capital base for commercial banks with international authorisation at N500 billion.

CBN spokesperson, Hakama Sidi Ali, confirmed the development in Abuja on Thursday.

According to Ali, the new minimum capital base for commercial banks with national authorisation is now N200 billion, while the new requirement for those with regional authorisation is N50 billion.

The announcement comes just days after CBN Governor, Olayemi Cardoso urged deposit money banks to expedite action on the recapitalisation of their capital base in order to strengthen the financial system.

Is CBN governor Yemi Cardoso unwittingly using the recapitalization as a strategy to force out the forex the banks are hoarding?

Is CBN governor Yemi Cardoso unwittingly using the recapitalization as a strategy to force out the forex the banks are hoarding?

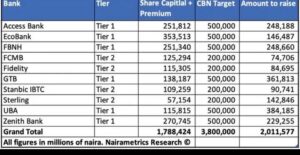

The top 5 banks are facing a N1.5 trillion deficit in meeting the new capital requirement set by CBN for the New Capital Base.

According to the updated minimum capital regulation, each of the leading five banks – Access Bank, FirstBank, GTBank, UBA, and Zenith Bank – is required to maintain a minimum capital base of N500 billion.

The five banks are expected to have a total paid-up capital and share premium amounting to N2.5 trillion.

The top five banks have a combined paid-up capital and share premium of N1.037 trillion, which falls short by N1.472 trillion.

Access Bank has paid-up capital of N251.811 billion, shortfall of N248.189 billion.

FBN Holdings, has paid-up capital of N251.3 billion,shortfall of N248.66 billion.

The GTBank paid-up capital of N138.186 billion as of Q3’23, shortfall of N361.814 billion

UBA has paid-up capital of N115.815 billion, shortfall of N384.185 billion

Zenith Bank has a paid-up capital of N270.745 billion, shortfall of N229.255 billion.