Repo rate remains unchanged at 8.25%.

The Monetary Policy Committee (MPC) of the South African Reserve Bank (SARB) has decided to hold the repo rate unchanged at 8.25%.

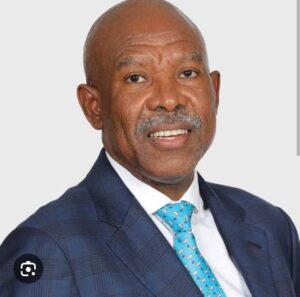

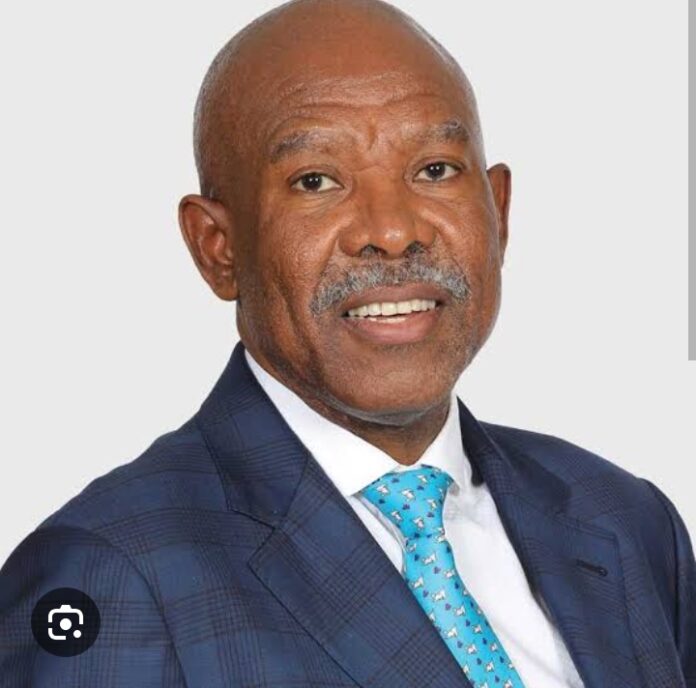

Addressing a media briefing on Wednesday, SARB Governor Lesetja Kganyago said the decision was unanimous.

“In assessing this forecast, the MPC noted a range of risks. Inflation expectations have moderated in the latest survey. This is welcome, but two year ahead expectations are still in the top half of our target range,” Kganyago said.

He said expectations are projected to ease towards the 4.5% objective as inflation slows.

“Regarding food prices, we are at a difficult juncture. Last year, food inflation hit its highest levels since 2008. Food inflation has now slowed. But this is a critical time in the growing season, and it has been unusually hot and dry, which may cause food inflation to pick up again.

“Considering the exchange rate, the rand has been trading somewhat weaker than we expected at our last MPC meeting. This is partly due to interest rates in the major advanced economies staying high for longer. The currency is also under pressure from weakening terms of trade. Furthermore, investors see significant near-term domestic uncertainty. We view the exchange rate as undervalued,” Kganyago said.

He said at this level of rates, the policy stance is considered restrictive, consistent with the inflation outlook and the need to address elevated inflation expectations.

“The inflation and repo rate projections from the Quarterly Projection Model remain a broad policy guide, changing from meeting to meeting in response to new data. Committee decisions will continue to be data dependent, and sensitive to the balance of risks to the outlook. Stabilising inflation at the mid-point of the target band will improve the economic outlook and reduce borrowing costs,” the Governor said.

He reiterated the views of the committee on additional measures that would improve economic conditions.

“These include achieving a prudent public debt level, improving the functioning of network industries, lowering administered price inflation, and keeping real wage growth in line with productivity gains,” Kganyago said. – SAnews.gov.za